SWOT Analysis of BRICS Financial Cooperation

BRICS[1] becomes a newly rising star targeting regional financial cooperation at the backdrop of globalization and financial integration. From its yearly summit to meeting amidst Brisbane G20 summit, every step of this group attracts attention from other G20 members. Similar to G20, BRICS attaches great importance to financial cooperation, for example, economy (33% of the discourse) and finance (almost 20%) dominate its agendas (Marina Larionova and Mark Rakhmangulov, 2012). In this paper, BRICS financial cooperation is studied by adopting SWOT analysis and implications are given. The aim of this study is to analyze BRICS financial cooperation objectively and give hints in areas that BRICS can break through to achieve better cooperation with G20.

Get Help With Your Essay

If you need assistance with writing your essay, our professional essay writing service is here to help!

Presently, research on BRICS financial cooperation remains few generally, which are also mainly theoretical. Chun-Yao Tseng (2009) analyzes innovation capability of BRICS countries and concludes the strengths and weakness of them respectively. Vivek Bhargava et al. (2011), based on theory of interest rate parity, believe that further liberalization of financial market among BRIC countries increases the integration of their currencies into global financial market. Robert Kappel (2011) studies development momentum of BRIC countries by collecting economic indicators from World Bank and contends that BRIC cooperation forms a big challenge to Europe and US economy. Sang Baichuan et al. (2012) give view on measures to further deepen financial cooperation from aspects of the current situation, problems, and prospects of BRICS, so as to promote trading and economic development. Wu Guoping and Wang Fei (2013) illustrate opportunities and challenges for BRICS countries. Similarly, Hu Qilin and Zhang Hanlin (2013) come up with cooperation strategies for BRICS financial cooperation, such as cultivating BRICS bond market and forming BRICS financial cooperation council. Considering the fact that none of the previous literature provides a SWOT analysis, this paper will be extended from this viewpoint.

I Strength

The outbreak of 2008 global financial crisis highlights the BRICS countries` good performance, also enlightens them to seek for better future. For BRICS members sharing great commonality and good complementarity in economy and finance, collaboration particularly in finance is the best choice. Naturally, the commonality and complementarity are becoming the very endogenous strength for BRICS. Their commonality lies in economic growth, backed up by attractive huge land area, big population, rich natural resource. Being both developing countries and emerging markets, most of the five countries are exceeding western economies in growth rate recently, when western economies are completely shell shock (see chart 1). The relative growth advantage fosters fiscal and financial development in each members, which can be partly manifested in the increase of foreign reserve. Brazil, Russia, India, and China are among the top 10 foreign reserve countries, with total reserve reaching $4.6 trillion, three quarter of world aggregate (Wu Guoping and Wang Fei, 2013). It is no wonder that BRICS countries have become the most favored investment destination (see chart 2), laying a good foundation for financial cooperation.

Chart 1 GDP Growth Rate in BRICS, US, and Euro (2010—2013)

Source: Hu Qiwei and Zhang Hanlin, “A Study on Cooperation Strategy for BRICS Members,” Inthernational Trade, Vol. 6, 2013.

Chart 2 Inflows of FDI in BRICS Countries

Source: BRICS Joint Statistical Publication 2014.

But they also have big complementarities in their factor endowment advantage. Namely, Brazil is a famous agricultural country, known as “a raw-materials backyard”; China, leader in manufacturing, is praised as “world`s manufacturing factory”; India`s software industry enjoys a great reputation in the world, which gives it a name of “the world`s office”; Russia is the biggest oil and gas exporter, thus regarded as “the world`s energy and gas station”; South Africa is one of the five biggest mineral states, world`s biggest gold and platinum exporters, and leader in deep-ocean mining. In all, India and China are manufacturing countries when Brazil, Russia, and South Africa are resource countries. These complementarities help to form distinctive circles of trade and investment, which can further promote financial cooperation. Between 2002 and 2012, intra-BRICS trade increased 922%, from $27 to 276 billion, while between 2010-2012, BRICS international trade rose 29%, from US$ 4.7 to 6.1 trillion dollars (VI Summit).

II Weakness

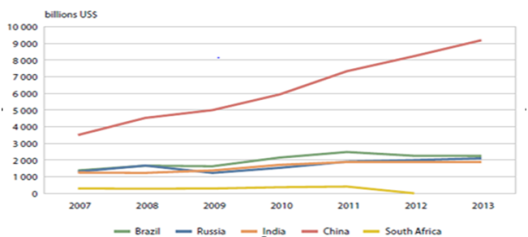

Though BRICS is striking the whole world with its recent good performance, some negative factors of them cannot be neglected. This is, to a large extent, attributed to their national conditions. The leading factor could be the per capita GDP which is dragging them even under a good overall context. “Based on the 2013 GDP per capita released by World Bank, the rank of BRICS countries still way lag behind western countries with Russia 44th, Brazil 74th, South Korea 80th, China 92th, India 127th out of 180 countries and regions,” Wu Guoping and Wang Fei (2013) stress. This fact not only proves the gap as always between BRICS and other countries and regions, but also shows the development at uneven space within the group. The worse situation is that since 2011, BRICS (apart from China) GDP growth rate moderates (see Chart 3).

Chart 3 GDP of BRICS Countries From 2007 to 2013

Source: BRICS Joint Statistical Publication 2014

Then, how to balance the inter-conflicts and financial cooperation will be the long disucssed topic for them. The big disparity in geography, religion, political system and the like are hindering the intra-cooperation (Sang et al., 2012). These factors even evolve into fire of conflicts and frictions. For example, low labor cost makes Chinese commodities enjoy comparative advantage in Brazil`s market, but results in 54 anti-dumping cases from 1989 to 2011 (Wu Guoping and Wang Fei, 2013); India and China have numerous disputes and there are escalated border tension between them since fifty years ago; China and Russia initiate negotiation on the pricing of oil and gas, but the process is repeated and difficult. Needless to say, the inter-conflicts will interrupt pace of financial cooperation.

Recently, all members face similar development bottleneck in economy, like low status in the global industrial chain, unsound export commodity structure, and high dependence on foreign demand. Moreover, apart from South Africa, the rest four are in the face of unsound financial system with indirect financing as the main channel while direct financing strongly limited. The underdeveloped capital market in BRICS countries comparing with developed countries says a lot. In addition, BRICS suffers homemade problems. In Brazil, overbearing taxes, red tape and poor infrastructure have hampered competitiveness. Russia`s economy is highly dependent on oil and natural with 75% export are oil and gas, which make itself lack of diversity and thus less flexible (Samantha Azzarello and Blu Putnam, 2012). India has long been in the troubles of social inequality, sanitary problem, religion conflict. China’s new leaders are facing a long, difficult process of reshaping the country’s tapped-out growth model and contending with rising debt levels that threaten the nation’s financial stability. South Africa is plagued with high levels of continued unemployment, growing dualism in labor market, low levels of entrepreneurialism among black population (Handy et al., 2013).

III Opportunity

Many facts show that BRICS is winning increasing support, as it delivers spill-over effect to others and endeavors to integrate appeals and strength of developing nations and regions. According to IMF (2011), the emergence of BRICS has boosted exports of low-income countries (meanwhile are developing countries), improved terms of trade and productive capacity; its development financing help many low-income countries alleviate infrastructure bottleneck and reduce poverty. Additionally, BRICS helps emerging countries to have greater voices and representation in international organizations. In the first joint statement, BRICS countries demonstrated their will to play an bigger role in international organizations, particularly IMF and World Bank. Accordingly, on May 5th, 2010, IMF group board passed “quota reform” which would increase the clout of emerging countries to 6% (Dhar, 2014) . The increased quota of BRICS can be seen in Table 1.

Table 1 BRICS Qouta Share and Voting Right in IMF

|

Country |

SDRs (billion) |

Percentage (%) |

Number of Votes |

Total Vote (%) |

|

Brazil |

4,250.5 |

1.79 |

43,242 |

1.72 |

|

Russia |

5,945.4 |

2.50 |

60,191 |

2.39 |

|

India |

5,821.5 |

2.44 |

58,952 |

2.34 |

|

China |

9,525.9 |

4.00 |

95,996 |

3.81 |

|

South Africa |

1,868.5 |

0.78 |

19,422 |

0.77 |

Source: IMF, IMF Members¼‡Quotas and Voting Power, and IMF Board of Governors, Last Updated: February, 2015.

IMF and World Bank are losing clout in developing countries (Mark Weisbrot, 2013), because of policies being proved harmful to developing countries, such as IMF`s conditionality eroding economic sovereignty in Asian countries like Thailand, Indonesia, and South Korea (Catherine H. Lee, 2003). On top of that, western countries are busy handling their own problems. US, being the big brother for many years, is faced with QE exiting; European countries` economic recovery remains weak; Japan is battered by its big fisical deficit, etc. Undoubtedly, these, along with support from emerging world, give BRICS favorable external situation. BRICS established a development bank with 100 billion contingency reserve asset, aiming to mobilize resources for infrastructure and sustainable development projects in other emerging and developing economies, showing its efforts to promote financial cooperation among countries and will to supplement the efforts of multilateral and regional financial institutions for global development, thus contribute to collective commitments for achieving the goal of strong, sustainable and balanced growth (Indiatoday, 2014).

IV Threat

Ever since its establishment, BRICS is not free from doubts and rivalries. As in 2012, “BRICS has no structure yet. It was set up by political will,” said Alexander Tikhomirov (Nicholas Kotch, 2012). And its development bank has long been the target of doubt. Al Jazeera (2013) reported, “Leaders from the so-calledBRICS group of emerging nations have failed to launch a much-anticipated new development bank to rival western-dominated institutions like the World Bank.” TheVoice of Americadeclared (Funeka Yazini April, 2013), “BRICS summit ends without development bank deal.” Firstpost (2013) claimed that BRICS bank is just a castle in the air. Without exception, all media underline the lack of implementation. Actually, criticism from the west shows their wariness towards BRICS.

Find Out How UKEssays.com Can Help You!

Our academic experts are ready and waiting to assist with any writing project you may have. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs.

View our academic writing services

Still, distrust is lingering on this newest structure. So far, there are some other homogenous structures in different parts of the world. On the one hand, African Union, ASEAN, the Caribbean Community, the Arab League are placed high expectation, but achieve little after having the eyes of others on them for long, and thus bring disappointment. On the other hand, the impact of the BRICS in financial cooperation is further limited through the emergence of new plurilateral structures of informal or formal cooperation between emerging countries and sub-groups. Obviously, there is an invisible competition between BRICS and other homogenous institutions in the area of financial cooperation.

V Conclusion and Implication

With the help of SWOT analysis, the conditions BRICS are having and the challenges BRICS are facing in financial cooperation become clear, as is shown in the matrix diagram below drawn from content discussed above. Accordingly, strategies can be made and implemented in line with this diagram. For better intra-cooperation within group and international cooperation with G20, BRICS can set about bosltering financial cooperation mainly from monetary system, financial market, and global engagement. For each member domestically, central banks should further expand currency swap[2] bilaterally or multilaterally for reducing financing cost and dissolving instability in foreign exchange; governments need to attach more priority to financial market restructuring, trying to offset their unsound financial basis. For cooperation with G20, this group should continue to follow obligation and rules proposed by G20, and make its objectives conform to G20 framework to achieve win-win result. After all, BRICS is a newcomer, so there are more to consider, like internal interest division, more detailed operating mechanism, memorandum of understanding. The future will show, whether this new structure will be able to really play the role, which their initiators want them to play.

Table 2 SWOT Matrix Diagram of BRICS

|

Category |

Advantageous Factors |

Disadvantageous Factors |

|

|

strength |

weakness |

||

|

Internality |

opportunity |

|

|

|

Externality |

threat |

|

|

Reference

Al Jazeera. “BRICS nations fail to launch new bank.” 2013. http://www.aljazeera.com/news/africa/2013/03/2013327145258420830.html.

Azzarello,Samantha and Blu Putnam. “Slowing Growth in the Face Of Internal and External Challenges.” Market Insight. 2012

Baichuan, Sang, Liu Yang, and Zheng Wei. “BRICS Financial Cooperation: Current Situation, Challenges, and Prospects.” International Trade. Vol. 12, 2012.

Besada, Hany, Evren Tok, Kristen Winter. “South Africa in BRICS.” Africa Insight. Vol. 42(4), March, 2003.

Biswajit Dhar. “Hope of new financial institutions at BRICS summit.” Chinadaily. 2014. http://www.chinadaily.com.cn/opinion/2014-07/14/content_17768221.htm.

Brazilian Institute of Geography and Statistics. “BRICS Joint Statistical Publication 2014.” 2014.

Funeka Yazini April. “Criticism of the BRICS Bank Creation Unwarranted.” Chinafrica. 2013. http://www.chinafrica.cn/english/Opinions/txt/2013-05/22/

content_546512.htm.

Guoping, Wu, Wang Fei. “Opportunities and Challenges for BRICS Financial Cooperation.” Quanqiuliaowang. Vol. 12, 2013.

IMF. “New Growth Drivers for Low-income Countries: The Role of BRICs.” 2011

Indiatoday. “Victory for Modi, India as BRICS summitclears setting up of a new development bank,” http://indiatoday.intoday.in/story/

modi-victory-brics-summit-clears-a-new-development-bank/1/372582.html.

Kotch Nicholas.“Doubt over Brics bank’s economic feasibility.” BusinessDay. 2012. http://www.bdlive.co.za/business/financial/2012/09/26/doubt-over-brics-banks-ec onomic-feasibility.

Larionova, Marina and Mark Rakhmangulov. “BRICS in the System of Global Governance.” 2012.

Lee Catherine H. “IMF in the Asian Financial Crisis.” Vol. 24:4. 2003.

Robert Kappel. “The Challenge to Europe: Regional Powers and the Shifting of the Global Order.” Intereconomics ( S0020-5346 ), 2011, ( 46 ) : 275-286¼Ž

The BRICS National Statistical Offices. “BRICS Joint Statistical Publication 2014.” BRICS. 2014.

Venky Vembu. “BRICS Bank is just a castle in the air .” Firstpost. 2013. http://m.firstbiz.firstpost.com/economy/brics-bank-is-just-a-castle-in-the-air-3807 4.html?most-popular.

Vivek Bhargava¼ŒAkash Dania¼ŒD¼ŽK¼ŽMalhotra. Covered Interest Rate Parity Among BRIC Nations [J] . Journal of Business & Economic Studies ( S0144¼3585 ), 2011, ( 17 ) : 37-47¼Ž

VI BRICS Summit. “Economic Data and Trade Statistic.” http://brics6.itamaraty.gov.br/about-brics/economic-data.

Weisbrot Mark. “IMF and World Bank are Losing Clout in Developing Countries.” the Guardian. 2013.

Yao Tseng, Chun¼Ž“Technological Innovation in the BRIC Economies.” Research Technology Management (S0895¼6308) , 2009, (52) : 29-35¼Ž

[1] The “BRICS ” concept was first introduced by Jim O Neill in “Building Better Global Economic BRICS ” in 2001. This acronym refers to five most significant emerging economies-Brazil, Russia, India, China, and South Africa, taking the lead in economic growth among developing countries.

[2] Aswapis aderivativein which twocounterpartiesexchangecash flows of one party’sfinancial instrumentfor those of the other party’s financial instrument.

Cite This Work

To export a reference to this article please select a referencing style below: